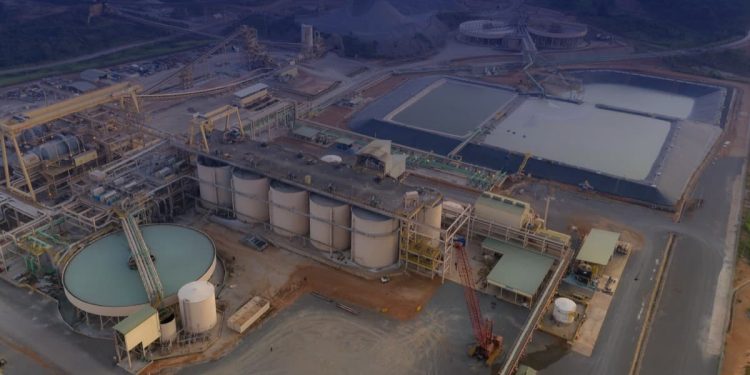

Newmont Corporation has announced that it will sell its Akyem operations to Zijin Mining Group Co., Ltd. under a definitive agreement for cash consideration of up to $1 billion. The sale is part of Newmont’s ongoing program to divest non-core assets as the Company makes a strategic shift to focus on its Tier 1 assets.

Under the terms of the agreement, Newmont is expected to receive cash consideration of $900 million upon closing and a further $100 million is expected to be received upon the satisfaction of certain conditions.

Proceeds from the transaction will support the Company’s capital allocation priorities, including strengthening the balance sheet and returning capital to shareholders.

According to a statement cited by Citi Business News, the transaction is expected to close in the fourth quarter of 2024, contingent on satisfaction of customary conditions precedent, including regulatory approvals. As a result, the transaction is not expected to have a material impact on Newmont’s 2024 outlook and the Company has not adjusted its non-core guidance for the year.

Newmont’s President and Chief Executive Officer, Tom Palmer, expressed confidence that Akyem operations will continue to thrive under new ownership with long-term benefits for local stakeholders and surrounding communities

Newmont says it remains committed to Ghana, including the investment of $950 million to $1,050 million of development capital in the Ahafo North gold mining project in the Ahafo region of Ghana.

source: Citi Newsroom